By The Spy

KAMPALA.

Uganda’s debt portfolio, including both disbursed fund and signed credit facilities, has reached a staggering Shs37 trillion, eclipsing the national budget read on Thursday and theoretically exposing each Ugandan citizen to Shs1m debt liability at birth.

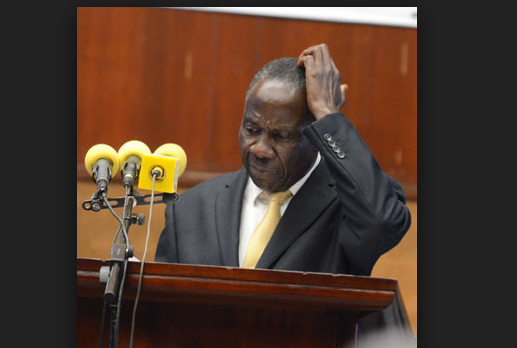

Mr David Bahati, the State minister for Economic Planning, said up to 63 per cent of the received monies was borrowed internationally while 37 per cent is domestic debt.

“…government’s debt exposure plus undisbursed external debt [stands at] $10.5 billion or Shs37 trillion and this external debt exposure does not include loans that are yet to be committed,” Mr Bahati said in an interview on Uganda’s debt status and planned procurement reforms.

The piling debt is an anti-climax for a country for which the Bretton Woods institutions in 2000 waived $2b under the Highly-Indebted Poor Countries Initiative (HIPC) in “recognition by the international community of the progress made in implementing economic reforms and poverty reduction.”

Whereas Uganda has over the past two decades reduced poverty by more than half, to the current 19 per cent, the reduction and associated growth in the economy has been fueled more by borrowing.

The insatiable appetite for borrowing is “unsustainable”, the Uganda Debt Network director of programmes Mr Julius Kapwepwe said last week, warning that it amounted to mortgaging future generation to an imposed obligation to pay back.

“It is the citizens who will have to pay back these debts. Unless our government becomes more disciplined with regard to borrowing, Ugandans will end up choking on debt like before under the Highly Indebted Poor Country Initiative (HIPC),” said Mr Kapwepwe.

The average annual income of a Ugandan stands at $705 or Shs2.5m.

Minister Bahati said that “as government, we are very cautious about the terms of these loans and the largest percentages of the loans contracted are through concessional financing”.

The government has borrowed billions of dollars mainly from China for construction of Karuma and Isimba dams, expected to add 783 megawatts of electricity to the national grid, as well as for road projects.

It is scouting for another $10b for building oil pipeline, a refinery and the standard gauge railway which, if secured, will double the country’s debt portfolio.

Such a trend, said country director Action Aid Uganda Arthur Larok, is evidence that the “political leaders have failed to run the country” and more borrowing will stymie its long-term economic development.

The World Bank has revised Uganda’s economic growth for the ending financial year downwards by a digit to 3.5. The massive failure of crops due to prolonged drought has increased food prices and inflation, adding to the troubles of an economy wobbling with reduced export earnings as the lucrative South Sudan market is impaired by an enduring conflict.

“Whereas there was negative growth in the first quarter of the year, the index of economic activity and the business tendency indicators show positive performance in the second and third quarters of the year,” Mr Bahati said in the interview.

During a visit in January, this year, the International Monetary Fund Managing Director Christine Lagarde warned that reliance on borrowing to finance infrastructure development was “unworkable” because the debt would increase to levels difficult to service.

“Finance must come also from the mobilisation of domestic revenue,” she said.

This red flags notwithstanding, minister Bahati said Uganda still needs loans since it can currently only fund about 30 per cent of its Shs29 budget.

The infrastructure projects being undertaken are cornerstones of the National Development Plan (NDP II), he said, and will help lift Uganda toward attaining a middle-income status by 2020.

He said that without proper infrastructure in place, there will be challenges in supporting the productive sectors such as agriculture, small and medium-income enterprises as well as other and private sector investments which will in turn hinder growth.

Dr Fred Muhumuza, a development economist, said ‘’Uganda may soon develop a junk economy status just like South Africa if government does not ensure that borrowed funds are put to the rightful use”. A junk status makes a country prone to defaulting and unappealing to creditors, impinging a country’s ability to secure foreign financing.

Dr Muhumuza urged government to strengthen institutions that manage loans and that there is a need to have the legal framework to regulate continuous borrowing without accountability to citizens.