By Andrew Irumba

If the allegations of money laundering against former Bank of Uganda Director in charge of Banks supervision Justine Bagyenda are proved beyond reasonable doubt to be true, then the once powerful and fast raising riches African woman could join Geoffrey Kazinda at the university of Understanding for a 20 yr sponsored ‘course’, that’s according to opposition’s Governor Bank of Uganda and economics honcho Nathan Nandala Mafabi!

“The law about money laundering is clear, once she is convicted, she will serve 20 yrs in jail, and if the judge is kin enough, she can be ordered to even return back the money in question” Nandala was quoted on one of the Fm stations in Kampala clarifying on the matter.

The Budadiri west constituency member of parliament (MP) and former Public accounts committee Chairman (PAC) didn’t just end at talking about it, he promised to raise the matter at the floor of parliament as a matter of public concern so it can attract the attention of the speaker. In so doing Mafabi wants an independent parliamentary commission instituted by the speaker with powers to cause arrest and prosecution so that Bagyenda’s case can be put to rest.

There have been consistent rumors about former Executive Directive in charge of Supervision at Bank of Uganda Justine Bagyenda siphoning Billions of money irregularly using her positions at BoU as director and at Financial Intelligence Authority as a board member.

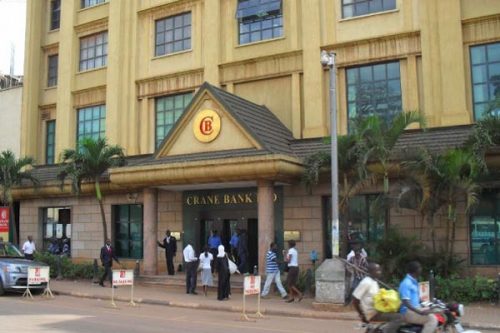

A can of worms was let loose when her alleged UGX 20 Billion transaction through her civil servants’ personal bank accounts in a period of six years made rounds on social media few weeks ago. This was at the foot heels of serious allegations that tycoon Sudhir Ruparelia’s Crane Bank had been sold to DFCU dubiously alsmost for samosa and that Bagyenda was fully involved as director supervision. Infact, our sources claimed that the legal team of the Bank heavily relied on her recommendations about the bank as the director supervision.

Few days ago, Barclays Bank became the second bank in two weeks to confirm that the account details of Ms. Bagyenda had leaked to the public, adding fuel to speculation that her financial history may be the most sensitive thing unearthed by investigations into the abuse of office by the once powerful central bank official.

On March 8, Diamond Trust Bank revealed that one of their employees had leaked her Account details and that management was taking serious disciplinary measures against the employee. It’s not different Backlays either,the employee who leaked the information to the media is being purged.

However FDC’s Nandala Mafabi says the two ‘whistles’ in the banks are supposed to get Gov’t protection instead! “There is a whistle blowers’ act, these gallant sons or daughters of the country are supposed to benefit from that act, if indeed it is to work. They are even supposed to be paid their percentage out of what might be recovered, that’s the law” Mafabi said.

Mafabi accused The Inspector General of Government (IGG) and Financial Intelligence Authority for remaining cagey on Bagyenda’s issue yet it was a serious matter. He vowed to do anything in his capacity as a lawmaker to compel Bagyenda to explain the source of the millions of dollars on her accounts.

“We are going to carryout investigations and we are going to deal with those banks because they have been doing illegal things with Bagyenda. Actually those banks should be closed because they have been involved in money laundering. That lady Bagyenda has been the head of anti-money laundering committee and the law that was passed, states that whoever participates in money laundering has to face prison for 20 years and that is why Bagyenda should have been in Luzira and the law says that the money she stole, should be returned,” Mafabi said

Banks Silent On Bagyenda’s Fat Accounts

No reason has been provided by Banks as to how large sums of money ended up on her accounts, apart from apologizing for the leaks to the media.

Bagyenda held 2 Accounts at DTB; a Prime Dollar Savings Account, No. 5106903904 and another Low Start Savings Account, No.5106903903- all in her names. It is these two accounts that formed the melting pot for the various transactions. One of her accounts at Diamond Trust Bank for instance, was found to have a whooping about US$ 15 million.

Her Barclays Bank Account, according to leaked information had a balance of Shs98m as of Oct 21st 2017.

At Barclays, the money would blend in together with her salary and or allowances from Bank of Uganda and the Microfinance Support Centre where she was the board chairman.

From her Barclays account she then made small–between UGX10 million and UGX30 million–but regularly (usually weekly) transfered to a certain Kenny Muwonge at Centenary Bank. Between August 2015 to September 2016, Bagyenda made 47 weekly wire (RTGS) transactions to Muwonge’s account No. 2120011273 in Centenary Bank, totaling to UGX693 million.

Governor Emmanuel Tumusiime Mutebile is country’s highest salary earner at Shs53.3 million per month, but Bagyenda’s bank details shows that for the last six months she has been earning or saving- Shs266,7223732, or earning Shs66.6 million per week, which translates into Shs9.5 million per day, surposing her own boss Governor Mutebile in earning!

The Anti-Money Laundering Act, 2013 (AMLA) defines money laundering as “the process of turning illegitimately obtained property into seemingly legitimate property and it includes concealing or disguising the nature, source, location, disposition or movement of proceeds of crime and any activity which constitutes a crime”.