By Andrew Irumba

The Supreme Court in Kampala has finally today directed that the management of Crane Bank be reverted to its shareholders but also Bank of Uganda to pay costs as the five-year battle came to an end.

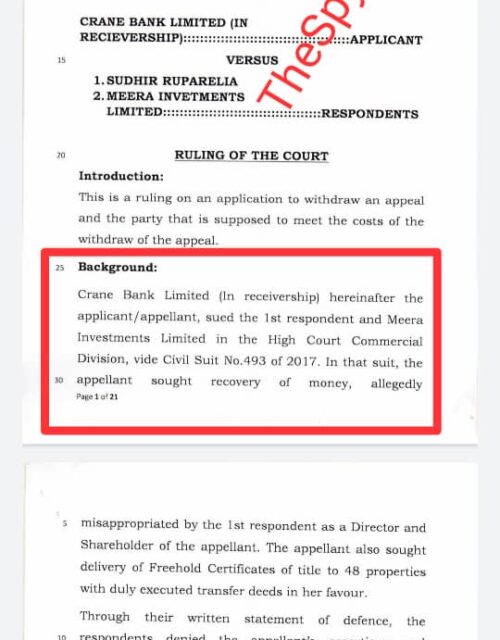

After selling the assets to Dfcu, Bank of Uganda filed a suit under Crane Bank in Receivership against Sudhir and Meera Investments seeking to recover over Shs400 billion and 48 land titles.

Click Here To Read Full Ruling

The suit by Crane Bank was dismissed by High Court with costs to be paid by the Bank of Uganda on the ground that a bank under receivership cannot sue, receivership had ended and Crane Bank was a non-citizen company that could not hold freehold titles. Bank of Uganda appealed to the Court of Appeal which unanimously upheld the findings of the High Court. Thereafter, the Bank of Uganda appealed the matter to the Supreme Court.

“An interlocutory mandatory injunction doth issue returning the status quo of the 1st respondent to what it was at the time of filing Civil Appeal No.07 of 2020. A declaration doth issue that the 2nd respondent is in contempt of court’s order,” the ruling read.

“The 1st respondent was closed as a financial institution and placed under receivership. Upon closer, it ceased being a financial institution under the Act and it could, therefore, not be progressed to liquidation. The 2nd respondent’s act therefore of moving the 1st respondent to liquidation are contrary to the above clear provisions of the law and the same cannot be sanctioned by this court,” reads the ruling.

However, before the hearing of the appeal, the Bank of Uganda decided to place Crane Bank into liquidation which materially altered the status of the Bank before the Court. Bank of Uganda’s application to change the status of the appellant from Crane Bank in Receivership to Crane Bank in Liquidation was equally dismissed by the Supreme Court.

Click Here To Read Full Ruling

But remember, Justice David Wangutusu of Commercial Court in August 2019 had dismissed the first case in which BoU claimed that Sudhir and his Meera Investments fleeced his own Crane Bank (now in receivership) of Shs397 billion.

BoU appealed the ruling however, shortly after, BoU sought to withdraw it before it could be heard, prompting Sudhir’s lawyers of Kampala Associated Advocates to object to the withdraw.

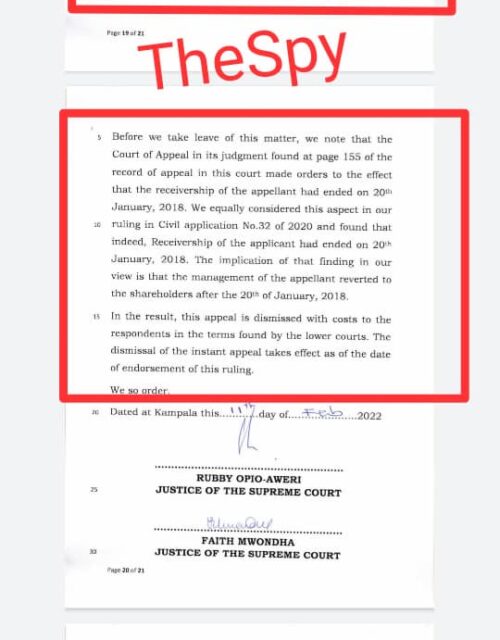

Now, on Friday, five justices of the Supreme Court including Rubby Opio Aweri, Percy Tuhaise, Ezekiel Muhanguzi,Prof.Tibatemwa Ekirikubinza and Faith Mwondha dismissed the appeal by BoU but also directed that the central Bank pay costs in the terms found by the Court of Appeal.

Click Here To Read Full Ruling

The five justices also reasoned with the Court of Appeal that management of Crane Bank be returned to the shareholders including Sudhir Ruparelia and Meera Investments Limited since receivership had ended in 2018.

“If all the parties to the appeal do not consent to the withdrawal of the appeal, the appeal shall stand dismissed with costs, except as against any party who has consented, unless the court on the application of the appellant, otherwise orders. At the time of filing the suit, the Bank of Uganda had taken over management. Counsel for the Plaintiff/Respondent submitted that the proceedings were not commenced by the Bank of Uganda but by Crane Bank Limited in Liquidation. A persual of the affidavit in reply to the application throws light on who brought the suit to court. The affidavit is deponed by Margaret K. Kisule who describes herself” reads the ruling.

It further continues “We agree with the learned Judge in dismissing HCCS 493 of 2017 and awarding costs following the dismissal. The preliminary objection in this case wholly disposed of HCCS 493 of 2017. There was therefore nothing left to try following the dismissal. We for those reasons find this ground in the negative……. in the instant case, we find no such misconduct relating to litigation on the part of the respondents and as such, we find no reason to deny the respondents costs of the suit. We, therefore, uphold the trial Judge’s order as to costs”

The judges in their ruling further said that in ruling civil application No.32 of 2020 and found that indeed, receivership of the appellant had ended on January 20, 2018. They said the finding in their view implied that the management of the appellant had reverted to shareholders after January 20,2018.

Click Here To Read Full Ruling

Sudhir’s lawyer Peter Kabatsi welcomed the decision saying that his client dedicated most of his time and resources over the last five years in pursuit of justice.

READ ALSO: At Cross Roads:BoU Bosses Clash Over Lost Case Appeal Against Tycoon Sudhir

On his part Sudhir has indicated that the monies he was accused of siphoning did not reach Crane Bank and that the Legal department of Bank of Uganda prolonged the case to continue benefiting from legal fees.

The tycoon said justice had prevailed the judiciary and courts had done its part. He further thanked his lawyers led by Senior Counsel Peter Kabatsi. He said if BoU is dissatisfied with the ruling, they can go and appeal to God.

Click Here To Read Full Ruling

“I want to thank the judiciary and the courts for giving me justice. It has taken more than five years to fight this case and it has impacted on our businesses. I want to thank all the lawyers for their time. Honestly BoU stole money in the name of Crane Bank and even Auditor General has said so. The legal department of BoU is so corrupt and is misleading the board. BoU legal department should go and appeal to God,” Sudhir said.

On his part, Counsel Kabasti hailed the ruling as well but said he wasn’t surprised by the ruling as it was expected. He said BoU should accept the consequences of the ruling since they dragged Sudhir to court.

“The implications are actually many and if anyone goes to court, he or she like BoU did should expect the consequences”. First of Sudhir lost a bank and time, That isn’t cheap and first he lost his bank which shouldn’t have been but because of the mistakes of BoU” He said.

Counsel Kabatsi the costs to be awarded will be calculated in accordance with the law.

Click Here To Read Full Ruling

Crane Bank started operations on 21 August 1995 “with a vision of being the largest privately owned Ugandan Bank.”

In September 2012, Crane Bank acquired the assets and some of the liabilities of the National Bank of Commerce, a small, indigenous, financial services provider in Uganda that had lost its banking license.

On 30 January 2014, Crane Bank established Crane Bank Rwanda Limited, a wholly owned subsidiary, with the first branch in Rwanda opening to customers on 30 June 2014.

Later, the Bank was closed by the Bank of Uganda on October 20, 2016, saying that it had failed to comply with a capital call on July 1, 2016. Back then, Central Bank Governor Emmanuel Tumusiime Mutebile said that the Bank takeover was guided by the systemic nature of the under-capitalized institution to avoid financial sector instability.

Click Here To Read Full Ruling

The bank was a large financial services provider in Uganda. As of 31 December 2015, Crane Bank’s assets were UGX:1.81 trillion, with shareholders’ equity of UGX:281.43 billion. In October 2015, it had more than 750,000 customers.