By Andrew Irumba

Parliament: The parliamentary Committee on Commissions, Statutory Authorities and State Enterprises (Cosase), which is investigating Bank of Uganda (BoU) over the controversial closure of seven commercial banks, has summoned former shareholders of all the closed banks to testify about the circumstances that led to the closure of their banks.

The Committee that is still chaired by Bugweri County MP Abdu Katuntu and deputized by Anita Among will resume work next week, beginning with former shareholders of National Bank of Commerce (NBC) and Teefe Bank together with Nile River Acquisition Company (NRAC).

NRAC is the now defunct offshore firm that was sourced by BoU to buy the assets and liabilities after the closure of International Credit Bank (ICB) Ltd (1998), Greenland Bank (1999) and the Co-operative Bank (1999).

The firm that was based in the tax haven Island of Mauritius bought the total loan portfolio worth Shs135b, including secured loans of Shs34.5b which had valid, legal or equitable mortgage on the real property, according to a forensic audit by the Auditor General.

The former shareholders of NBC, who are expected to be cross-examined by the committee, will include Prime Minister Dr Ruhakana Rugunda, Governor Tumusiime Mutebile, former Prime Minister Amama Mbabazi, and businessman Amos Nzeyi.

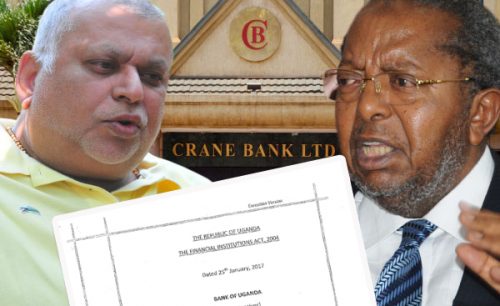

MPs will then meet former shareholders of International Credit Bank (ICB), Cooperative Bank, Crane Bank Ltd (CBL)and dfcu, the bank which took over the assets and liabilities of both Global Trust Bank (GTB) and Crane Bank. The committee will also hold meetings with the BoU Board of Directors and technocrats from the Finance ministry.

BoU officials are expected to respond to what Ms Justine Bagyenda, the former director of Supervision for Commercial bank, testified about the closure of banks last December.

Lawyers from Masembe, Makubuya, Adriko, Karugaba & Ssekatawa (MMAKS Advocates) will also be quizzed to explain how much BoU paid them as legal fees for several cases involving the closed banks.

MMAKS will also be required to clear the air on whether or not BoU hired them as transaction advisers in the disputed Crane Bank takeover at a fee of $251,045 (about Shs943.3m).

In handpicking MMAKS, MPs have already warned that Ms Bagyenda usurped the powers of the legal department by taking over the drafting of the terms of engagement between BoU and MMAKS.

With BoU failing to produce documents spelling out the terms of engagement, MPs have questioned why the bank opted to use external lawyers instead of its own legal team.

Meanwhile, Speaker Rebecca Kadaga has ruled that the committee has up to February 22 to complete investigations, table a report and handover to incoming chairperson Mubarak Muyangwa.