By Andrew Irumba

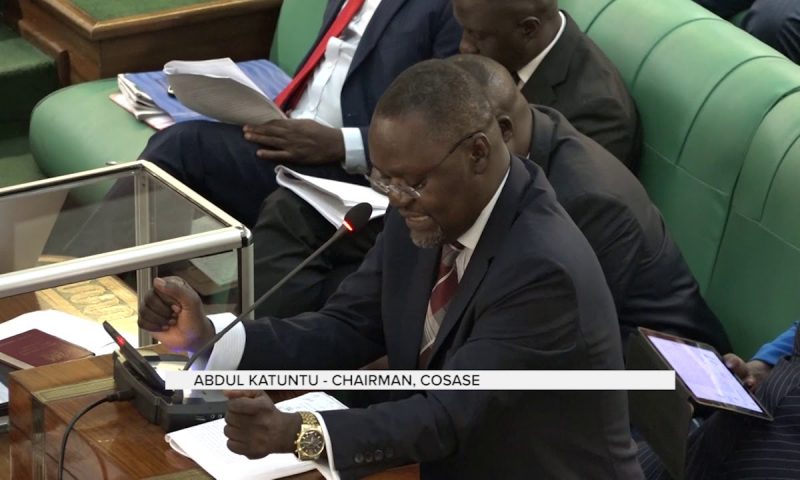

A report by the Committee on Commissions, Statutory Authorities and State Enterprises (COSASE) was finally presented before parliament Thursday afternoon by the committee chairman (Bugweri County MP) Hon.Abdu Katuntu.

The 64 page report has pinned bank of Uganda (BoU) and its top officials for causing financial loss to former Crane Bank (CBL) and the Bank of Uganda itself.

The report has thus made various ‘biting’ recommendations pinning BoU for having failed to value the assets and liabilities of closed Banks like CBL, Global Trust Bank and National Bank of Commerce, and that considering the lapse of time and impossibility in revaluation of assets, the Central Bank should address the probable financial loss occasioned by the side Banks.

Crane Bank Limited:

CBL was placed under statutory management on the 20th day of October 2016. The auditors were appointed on 28th October 2o16 and the inventory report was produced on 13th January, 2O17. This bank was sold on 25th January 20l7.

The committee observed, as it earlier did with other defunct banks, that there was no compliance with the requirement of Section 89(3) of the FIA, 2004.

(i) Without an explanation, the auditors were appointed on 28th October 2016, one week after takeover and sale which contravened section 89 (3) that requires the said appointment to be made as soon as possible as earlier observed.

(ii) Due to the absence of an inventory, the central Bank could not ascertain the value of what it took over.

(iii) The auditors produced the inventory report on 21st of December 2016, however, BoU had invited dfcu to bid for the purchase of assets and assumption of liabilities of CBL on 9th December 2016 and subsequently dfcu submitted the bid on the 20th December 2016, a day before the production of the inventory report.

(iv) BoU did not carry out valuation of the assets and liabilities of CBL BUT relied on the inventory report and due diligence undertaken by dfcu to accept their bid to arrive at the P&A. However, the final inventory report was submitted on 13th January 2017. In essence, the final inventory report was never used in evaluating the bid for the purchase of assets and assumption of liabilities of CBL.

(v) A perusal of some of the Non-Disclosure Agreements (NDAs) revealed that the Central Bank was disclosing confidential information of distressed financial institutions to potential purchasers who are competitors without their knowledge in total contravention of section 40 (3) of the Bank of Uganda Act.

The Katuntu led Committee report also castigated BoU for its decision to ‘lend’ dfcu bank Shs200 billions of CBL’s total loan book of Sha500 billion, which they said caused CBL a loss.

The report has recommended that all BoU officials who failed to properly execute their duties in accordance with the law should be held personally liable for their commissions/ or omissions that led BoU into carrying out illegal operations on the closed Banks.

The Central Bank officials the report recommended to be held liable who failed to do their job include Ben. Ssekabira, Director Financial Markets Development Coordination and Edward Katimbo Mugwanya, who was the statutory manager for CBL.

READ FULL REPORT HERE…COSASE REPORT

Others heavily implicated for failure to adhere to the FIA procedures are Governor Prof.Emmanuel Tumusiime Mutebile and his deputy Dr. Louis Kasekende.

The report also recommended that BoU makes good of the loss as they financially disadvantaged CBL by breaching the statutory duties provided in the Financial Institutions Statute, 2004.

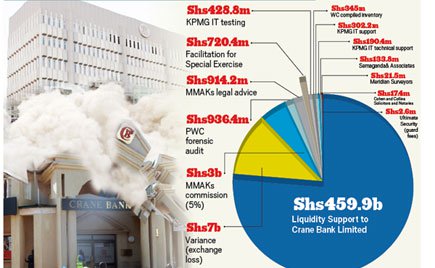

More so the report pins BoU on Shs478 billion which BoU wanted CBL shareholders to pay back on claim that it was used as liquidity support to CBL in receivership. The report wondered why BoU officials wanted CBL shareholders to pay yet they were not party to Shs200 billion purchase of assets and assumption of liabilities agreement that saw dfcu bank buy CBL, moreover money was paid in instalments.

The MPs in their report have recommended that BoU bears the cost of their negligence as far as the transaction was concerned.

The report also noted that at the time CBL was sold on January 25, 2017, it had gotten out of the financial distress even as BoU said it was still under receivership.

The MPs have also proposed a number of changes to the Financial Institutions Act that partly trims the powers of the central bank especially in the supervision of commercial banks but also have recommended that both the Governor and Deputy Governor be removed from being Chair and deputy chair of the BoU Board respectively.

“The board did not adequately supervise management in the process of liquidating the financial institutions,” reads part of the report, adding: “Good corporate governance principles would require that the position of chairperson and vice chairperson of the board is separated from the position of Chief Executive (Governor) and his Deputy.”

“It is therefore the recommendation of this committee that article 161 (4) (of the Constitution) be reviewed to separate the offices of the leadership of the board and top management of BoU,” the report, signed by 27 of the 35 member MPs on the committee recommended.

The MPs said that whereas in their 15th December 2016 meeting the board had resolved under minute no. 3754 paragraph 10, that the would-be buyer of CBL would take all the assets and liabilities after a forensic audit was out, the Management of BoU went ahead and concluded a sale agreement with dfcu that excluded some assets and liabilities.

They also blamed the BoU board for ratifying the sale that included charging interest on the Shs200 billion differed consideration at the CB rate on reducing balance basis, an act that in effect constituted a discount of Shs39 billion to the buyer but would be recoverable from the shareholders of Crane Bank.

In specific reference to the sale of Crane Bank, the MPs also found “The principles of legality therefore were highly compromised. This is exacerbated by the absence of minutes or any record detailing the process of arriving at the figures,” observed the MPs, further adding that failure to value the assets and liabilities of Crane Bank before selling it to dfcu was “imprudent”.

“The inevitable conclusion therefore is the BoU did not know the exact assets and liabilities it was disposing of. The reliance by the Central Bank on the due diligence undertaken by an interested party and eventual purchaser to purport to determine the value of assets and liabilities was imprudent and an abdication of statutory responsibility.”

The MPs also found that BoU sold CBL without the authority of the board, although the board later turned around to approve the decision, a decision MPs said was an abdication of its fiduciary responsibility.