By Spy Uganda

Anytime from now we may see a huge scandal involving Bank of Uganda (BoU) officials who are currently being grilled to explain how they seized and sold off assets of the Co-operative Bank of Uganda, without liquidating the institution.

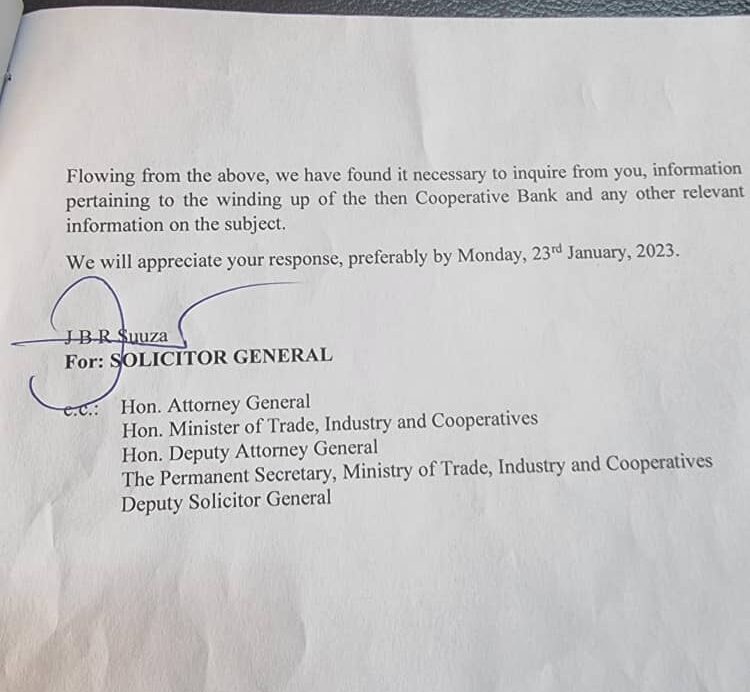

This has been revealed in a January 11 letter inked by JBR Suuza on behalf of the Solicitor General, to BoU Legal Counsel Margaret Kasule tasking her to explain where they got the authority to sell the bank.

“Which cooperative bank did BoU close? If it was the latter bank, why were the assets of the former seized and sold instead?” Suuza’s letter partially reads.

Solicitor General’s move comes after the Minister of Trade, Industry, and Cooperatives, Francis Mwebesa petitioned to the Attorney General saying by the time the 1997 Cooperative Bank was closed, “the process of turning the bank into a company had not been completed, neither had the ‘original’ Cooperative Bank’ been de-registered.”

TheSpy Uganda understands that Co-operative Bank that was registered in 1964 under the Cooperatives Act and has never been liquidated, abolished or de-registered.

Following the turbulent economic and political times, its operations were disrupted and it virtually collapsed with the collapse of the Cooperative Movement, as privatization and economic liberalization took root.

This matter also came up in the 2018/19 parliamentary probe into the closure of seven banks by BoU.

One of the contentious issues was the price paid for the assets of the bank. The report by the Committee on Statutory Agencies and State Enterprises, COSASE, noted that the assets were sold at a discount of 93 percent, which was described as a giveaway.

In-fact, during the probe, the Committee also discovered that BoU officials had connived in a fraudulent sale of tycoon Sudhir Ruparelia’s Crane Bank but lucky enough, the no nonsense tycoon was able to ignite a ‘bloody’ legal battle against the bank mafias to cough back his bank.

The Supreme Court in February 2022 made the historical ruling that sealed the 5yr battle by ordering the BoU to swiftly revert Crane Bank to Sudhir and also directly pay costs at all Court levels.