By Andrew Irumba

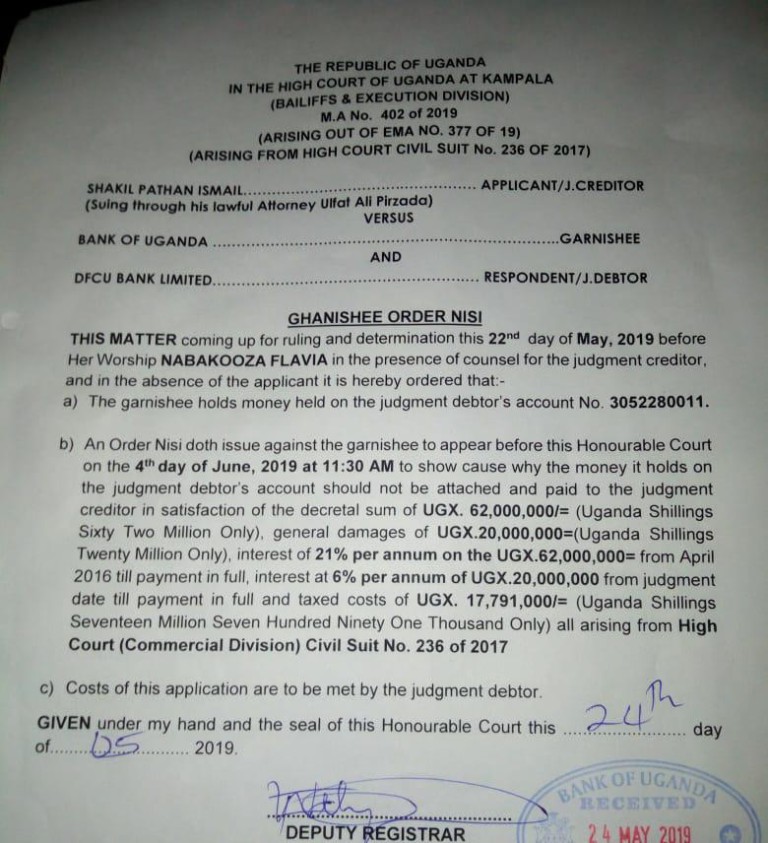

Bank of Uganda has been ordered to appear before the Bailiffs and execution division of the high court to explain why the money of a former Crane Bank employee being held in dfcu bank has not been paid as ruled by a high court about two months ago.

The former Crane Bank employee Ismail Shakil Pathan sued Bank of Uganda and dfcu bank indicating that wrongful deductions had been made on his account which had also been blocked without his knowledge.

The high court commercial division ruled in his favor indicating that over a period of one year about 62 million shillings had been wrongfully deducted from his account and that during the same period he was denied access to the rest of his income.

Court also directed BoU and dfcu bank to pay him the shs 62 million shillings and an extra 20 million shillings as general damages and warned that any delay would attract a 21% interest per annum on the shs62 million shillings and 6% per annum on the shs20 million shillings for damages.

Through his lawyers, Pathal took the matter to the bailiffs and execution division indicating that since January when the ruling was made, no money has been paid to him.

Her worship Flavia Nabakooza of the bailiffs and execution division has now directed BoU and dfcu to appear before her on the 4th of next month to show why they have not yet paid Pathan his money and why taxed costs amounting to 17 million shillings have also not been cleared as directed.

“An Order Nisi doth issue against the garnishee to appear before this Honourable Court on the 4th day of June, 2019 at 11:30 AM to show why the sum of UGX. 62,000,0001= (Uganda Shillings Sixty Two Million Only), general damages of UGX.20,000,000=(Uganda Shillings Twenty Million Only), interest of 21% per annum on the UG X.62,000,000= from April 2016 till payment in full, interest at 6% per annum of UGX.20,000,000 from judgment date till payment in full and taxed costs of UGX. 17,791,0001= (Uganda Shillings Seventeen Million Seven Hundred Ninety One Thousand Only) all arising from High Court (Commercial Division) Civil Suit No. 236 of 2017. Costs of this application are to be met by the judgment debtor,” ordered the court

In his ruling January 15, Justice Wangututsi declared that dfcu Bank can suffer all previous liabilities inherited from Crane Bank- provided the victims of these liabilities, were never privy to the purchase of Crane Bank Assets & Liabilities. In rejecting an application by dfcu Bank filed by city law firm MAKKS Advocates seeking to add Crane Bank as a defendant, Justice Wangutusi indicated that owing to an earlier ruling, the firm and that of city lawyer David Mpanga cannot represent any entity in any case against Crane Bank because an earlier court inquiry found them “conflicted”.

In December 2017, the Commercial disqualified Mr Masemmbe and Mr Mpanga from the sh397b Sudhir Ruparelia’s case against Bank of Uganda (BoU), citing conflict of interest.

The central bank in October 2016 closed Crane Bank, previously one of the best performing banks before controversially selling it dfcu Bank in January 2017 for a paltry Shs 200 billion.

Mr Sudhir has since indicated that he is determined to defend his Ruparelia Group’s integrity following the “dubious takeover” of Crane Bank, and fight to recover it after findings of the Auditor General and Parliament’s Committee on Commissions, Statutory Authorities and State Enterprises [COSASE] found out that it’s closure and six other banks, breached several provisions of the Financial Institutions Act 2014 and was therefore illegal.