By Our Reporter

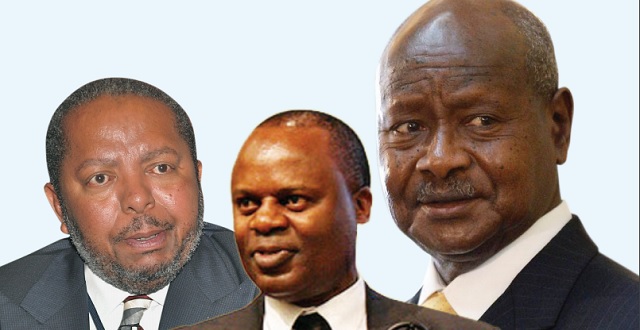

President Museveni has named Bank of Uganda and the Kampala Capital City Authority as some of top corrupt institutions in Uganda, despite them being top salary paying institutions.

The president while presiding over the celebrations to mark the 25th anniversary of Transparency International Uganda (TIU) at Imperial Royale Hotel in Kampala on Tuesday dismissed the notion that increment in the remuneration of public servants would be the cure to corruption, reasoning that public servants in government institutions like KCCA, Bank of Uganda, URA were still corrupt despite the high pay.

“Patriotism is the cure to corruption,” President Museveni said, indicating that he would speak more about the government’s new efforts to curb corruption on 10th December 2018.

The president’s bombshell will put more pressure on the Bank of Uganda, which is currently under investigation by the Parliament Committee on Commissions, Statutory authorities and State Enterprises (COSASE) over fraudulent dealings in the closure of commercial banks.

President Museveni already blocked an attempt by Finance Minister Matia Kasaija to obtain a Cabinet memorandum to stop the ongoing Parliamentary inquiry into Bank of Uganda with the Finance Minister reasoning that inquiring into its affairs would negatively affect the financial sector.

But President Museveni reportedly told Cabinet that he would not protect officials at the central bank being undressed before the Parliamentary inquiry because he tried to restrain them from closing Sudhir Rupareria’s Crane Bank Limited but they refused to listen to him.

The Parliament’s Committee on Commissions, Statutory Authorities and State Enterprises (COSASE) is conducting an inquiry into the conduct of the BoU and it’s officials in the closure of seven banks, with some of the actions ending up in massive controversy.

The MPs’ inquiry is also focusing on the mismanagement of closed banks by BoU after the Auditor General Mr John Muwanga issued a stinging criticism of the central bank in a special audit that cited massive flaws in the closure of Teefe Bank (1993), International Credit Bank Ltd (1998), Greenland Bank (1999), The Co-operative Bank (1999), National Bank of Commerce (2012), Global Trust Bank (2014) and the sale of Crane Bank Ltd (CBL) to DFCU (2016). All the former directors of the above-closed banks will also be cross-examined by the committee.

Some of the Bank of Uganda officials including the former executive director for Supervision Ms Justine Bagyenda, a key figure in the central bank’s drastic closure and handover of Crane Bank to DFCU Bank in 2017, have had a torrid time before the committee.

So far, Ms Bagyenda and Mr Benedict Ssekabira, the director of Financial Markets Development Coordination, have been carpeted after they failed to present evidence of reports on how the value of assets of three closed commercial banks assessed so far, was reduced from Shs117b to Shs98b after the Central Bank took over the liquidation. In the aftermath of the inquiry deputy governor, Dr. Louis Kasekende has had massive leaks of his vast property portfolio now a subject of verification by the Inspector General of Government.