By Spy Uganda

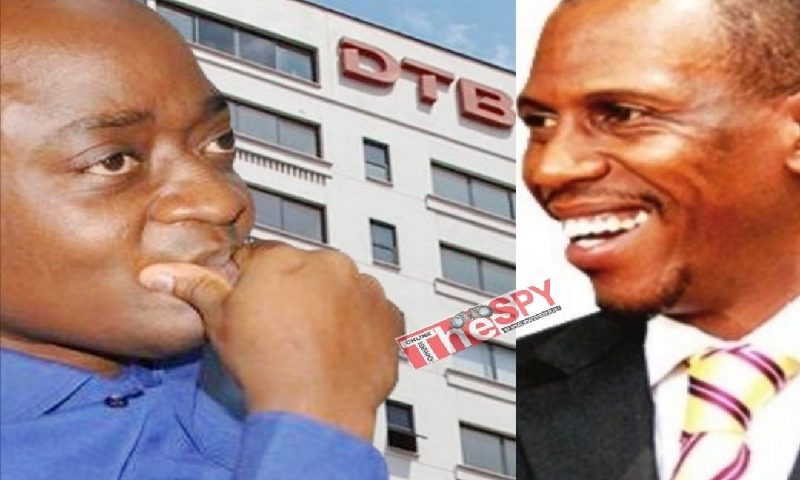

Kampala: The multi-billion fraud case between City tycoon Hamis Kiggundu and Diamond Trust Bank has become a sensitive case after Commercial High Court of Uganda’s Judge Henry Peter Adonyo decided not to make a ruling before the two parties have a memorandum of understanding meeting to agree on some vital issues.

This followed the two parties to appear smartly before the court today morning without an outcome of their MOU meeting yet it was a requirement in court.

READ ALSO: Commercial Court To Make Ruling In Ham,DTB UGX120B Fraud Case Tomorrow Monday

Among those who appeared in court today Monday, August 31, 2020 included Ham’s lawyer Fred Muwema who informed the judge that they failed to meet with the defendant’s side because of failure to have a joint scheduling memorandum driven by different opinions on a number of issues in this matter.

Lawyer Muwema said, “They served us a bank statement on Friday which i saw on Saturday yet i needed enough time to analyze it.”

He added that according to the defendant’s side, the meeting was meant to bridge the gap between the two parties yet the matter is supposed to be settled by court.

READ ALSO: Round 1: Mogul Hamis Kiggundu Floors DTB In UGX120b Case

However, on the above point, the Judge advised that it is not a must that the two parties to agree on all issues, but at least should agree on some essential facts.

However, in defense, DTB bank lawyer Kiryowa Kiwanuka, told the judge that they had tried with all it required to engage the plaintiff’s side but all did not bear fruits.

“We had agreed to meet on Saturday but later on the counsel told us that since we have areas of divergence, there is no need to meet” said Kiwanuka.

It is in this regard the that Judge decided through rules of proceedings, that since the two parties had failed to implement his directives which involved meeting first before appearing in court, not to listen to the case and therefore asked them to go back and meet and after report the outcome to the court before today ends.

“Basing on the rules of proceedings, the two parties are ordered to go back and first have an MOU meeting and agree on some essential facts on the matter and after, you are supposed to report the outcome to court before the end of today for resumption of the case” said judge Adonya.

Background Of The Case.

Diamond Trust Bank (Uganda) and Diamond Trust Bank (Kenya) argue that Kiggundu received a credit facility totaling over shs41b a few years ago and he still owes them about shs39b. In turn Kiggundu, accused the banks of fraudulently siphoning over shs200b from his accounts without his knowledge and consent over the past 10 years.

The banks adds that as of January 21, 2020, Kiggundu was in default on payment obligations of $6.298m on the loan facility of $6.663m, as well as sh2.885b on the demand overdraft facility of sh1. (https://northeastohiogastro.com/) 5b and the temporary demand overdraft facility of shs1b.

They further claim that Kiggundu was in default on the payment of another $3.662m out of a total loan facility of $4m and another $458,604 on a loan facility of $500,000, as of January 21, 2020.

However Kiggundu revealed that this was a financial fraud since the money was fraudulently withdrawn from both his dollar and shilling accounts were in excess of what the bank was demanding. “They said they had carried out an audit of my bank accounts and discovered that the money was siphoned off over a period of 10 years” Kiggundu said.

He highlighted that a total of sh29.035b, was unlawfully debited from his shilling account, while $22.93m was withdrawn from his dollar account under what he calls unclear debits. Kiggundu, who has been accessing loan facilities from the bank for over 10 years, issued a notice to the bank terminating his relationship and withdrawing the mortgage instruments.