By Andrew Irumba

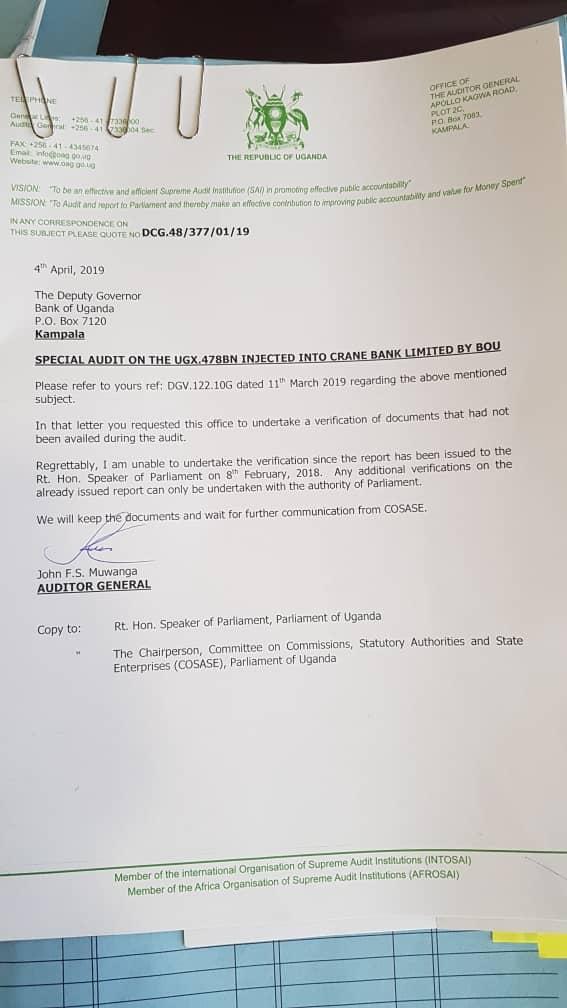

The Auditor General, Mr. John Muwanga has vehemently rejected new requests from Deputy Governor Bank of Uganda Dr. (www.nectarpd.com) Louis Kasekende to carry out a fresh inquest on the Shs478 billion the central bank reportedly is said to have injected into Crane Bank Ltd (CBL) after the takeover.

In a letter dated March 11, 2019, Kasekende wrote to AG requesting for a special inquiry into the same.

However, in his response letter dated April 4 2019, Muwanga told Dr. Kasekende he couldn’t carry out the verification because the report on the same subject was already with the Speaker.

“Regrettably, I am unable to undertake the verification since the report has been issued to the Rt. Hon. Speaker of Parliament on February 18, 2018. Any additional verification on the already issued report can only be undertaken with the authority of parliament” reads part of Muwanga’s letter to Kasekende which Spy Uganda got acopy.

In his response ,Muwanga also copied in the Speaker, Rt.Hon.Rebecca Kadaga who is still away Hospilalized at Agha Khan Hospital In Nairobi, and the new chairperson, Committee on Commissions, Statutory Authorities and State Enterprises (COSASE) Hon.Mubarrak Munyagwa.

Kasekende had requested the AG to undertake a verification of documents that had not been availed during the audit.

During the probe, Dr. Kasekende said when they put CBL in receivership, they acted as lender on side and borrower on the other side, something the Committee Chairman [then] Abdu Katuntu said created controversy in terms of accountability and transparency.

The MPs argued that BoU officials should have used a private or official receiver to manage CBL instead of doing it themselves.

Interesting to note is that BoU wants CBL shareholders led by city tycoon Dr.Sudhir Ruparelia who was the majority shareholder to refund the Shs478 billion yet they did not enter into any contract with them at the time of injecting in the side money.

But also, the Bank was already in receivership by BoU when they reportedly injected the said money meaning that it’s the same BoU management that was in-charge of business at that time.

CBL shareholders led by Sudhir told the probe that they would not pay that money since they don’t know where it came from, who received and how it was used. BoU officials have no documentation about the use of the money.

CBL only needed Shs157 billion to stay afloat even as BoU spent Shs478 billion on its liquidation.

BoU on the other hand has not presented any accountability of the money it says it spent as liquidity support to CBL as well as other service costs related to its liquidation.

The probe of BoU by the MPs was a result of the Auditor General John Muwanga’s report on commercial banks which faulted BoU for the closure of banks without following proper guidelines. Other closed banks include; Teefe Trust Bank, Global Trust Bank Uganda, International Credit Bank, Cooperative Bank, Greenland Bank and National Bank of Commerce.

AG did a special Audit Report on the Shs478 Billion Injected into Crane Bank Limited by Bank of Uganda and it pinned the central bank officials for failure to account for the said money it allegedly injected in CBL without documentation.

The Auditor General John Muwanga carried out the audit as ordered by parliament’s Committee on Commissions, Statutory Authorities and State Enterprises (COSASE) on December 20, 2018.

The Bank of Uganda officials during their exit meeting with COSASE failed to account for Shs478 billion they said they spent as liquidity support and other intervention costs on CBL receivership between October 20, 2016 and January 25, 2017.

Muwanga’s report said out of Shs478 billion injected into CBL, a sum of Shs157.9 billion had been recovered from Dfcu Bank and CBL Non-Performing assets leaving an outstanding balance of Shs320.8 billion at the time of writing the report. CBL at the time was sold to dfcu Bank at a paltry Shs200 billion, yet CBL only needed about Shs157 billion to remain afloat.

However, Muwanga noted in the report that much as BoU had a financial crisis management plan which provided for decision-making in the event of a systemic shock to the banking sector, the plan didn’t provide the process of injection of liquidity support to financial institutions during the statutory management period like it happened with CBL.

MPs warned BoU Governor Emmanuel Tumusiime-Mutebile and his staff who were appearing before COSASE to ensure that the loopholes identified were closed.

In one of his submissions during COSASE probe, the deputy governor BoU Dr. Louis Kasekende told COSASE members that the money was spent as; telegraphic transfers (TTs) and LC payments, Real Time Gross Settlement (RTGS), clearing and cash requirement requests.

An extra Shs12.2 billion was also spent on service providers including MMAKS Advocates who pocketed about Shs4.2 billion.

The latest report on Shs478 billion spent on CBL did not however audit the Shs12 billion paid by BoU to service providers, reasoning that it was extensively dealt with by the MPs.