By Andrew Irumba

Bank of Africa (BoA) has announced they have commenced criminal proceedings against their staff suspected to have leaked the account details of DFCU Managing Director Juma Kisaame.

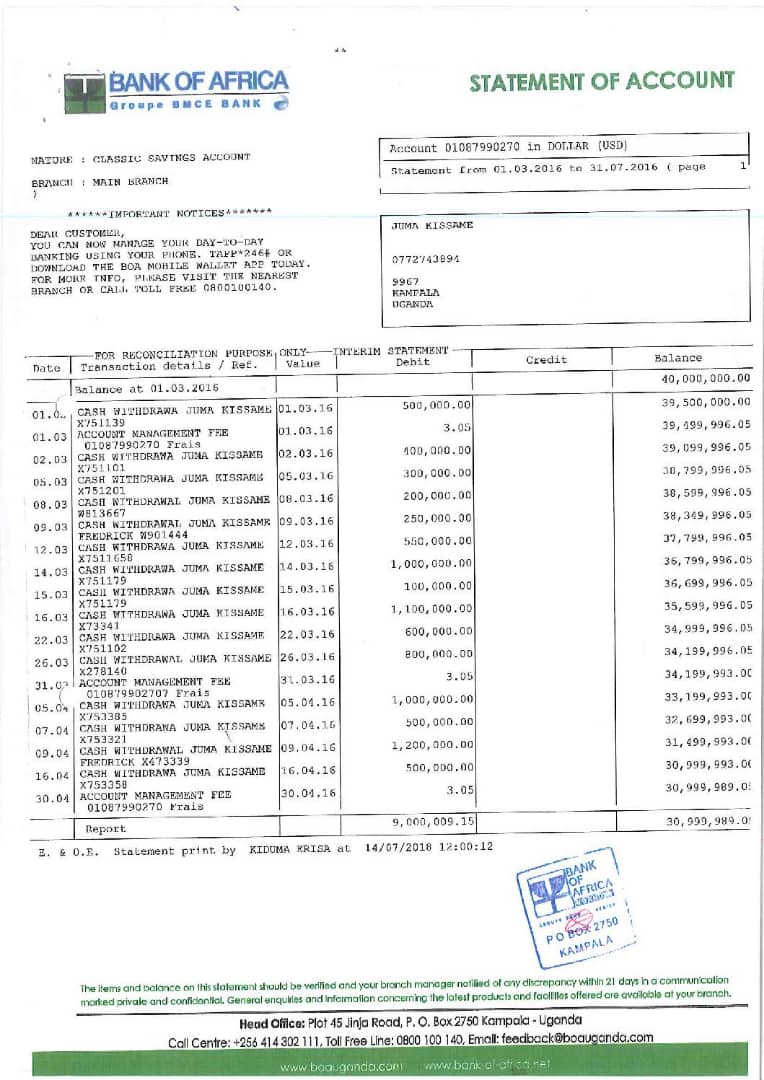

A leaked bank statement of account belonging to Mr. Kisaame, who is currently under stoplight in the aftermath of the DFCU controversial takeover of the Crane Bank fallout, went viral over the weekend indicating that the senior banking executive had $40 million stacked on his Bank of Africa dollar account.

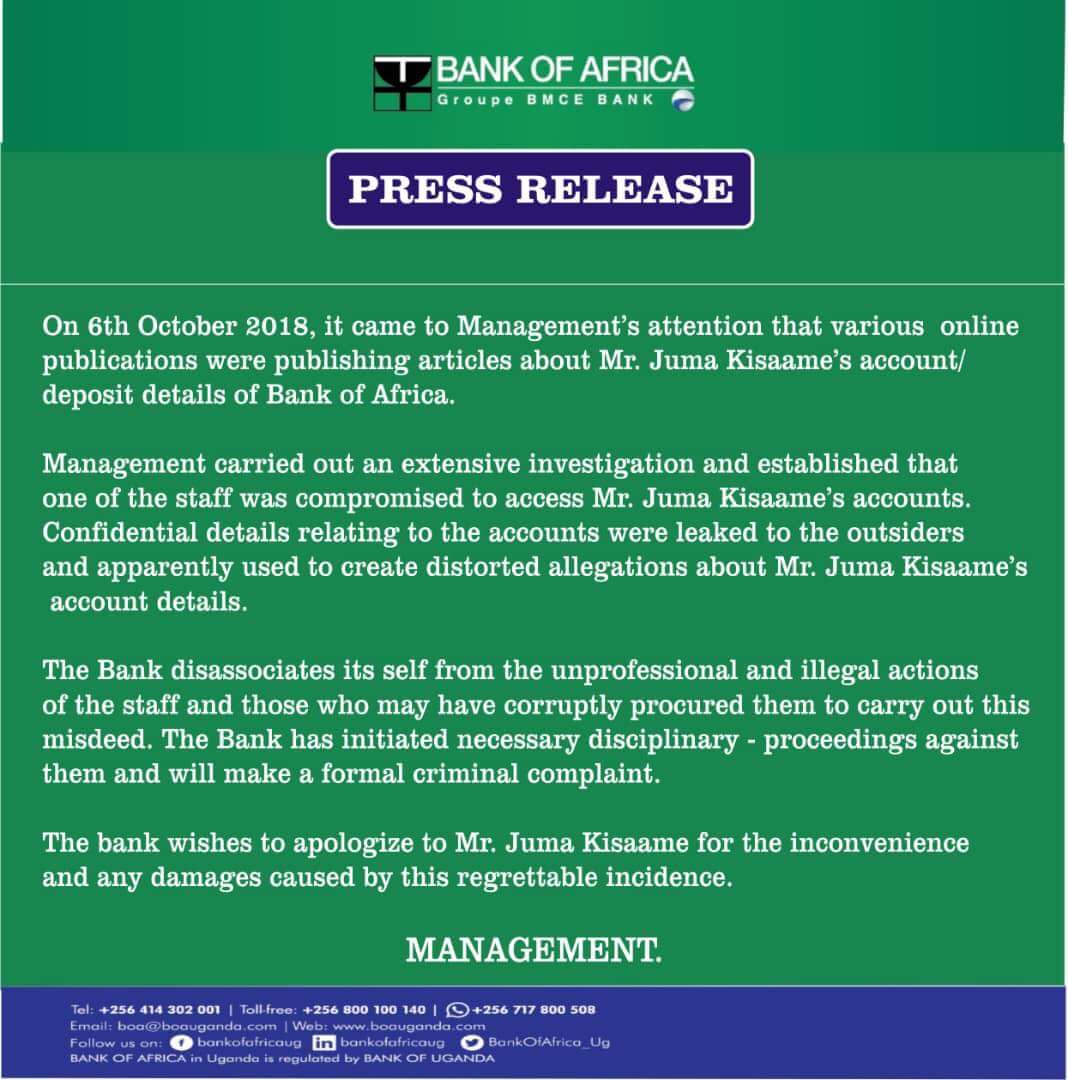

In a statement issued on Monday, the Bank of Africa apologized to Mr. Kisaame for the breach of contract and said that the staff involved would be reprimanded and handed over to police for criminal investigations.

“On 6th October 2018, it came to Management’s attention that various online publications were publishing articles about Mr.Juma Kisaame’s account/deposit details of Bank of Africa.

Management carried out an extensive investigation and established that one of the staff was compromised to access Mr.Juma Kisaame’s accounts. Confidential details relating to the accounts were leaked to the outsiders and apparently used to create distorted allegations about Mr. Juma Kisaame’s account details.

The Bank disassociates its self from the unprofessional and illegal actions of the staff and those who may have corruptly procured them to carry out this misdeed. The Bank has initiated necessary disciplinary – proceedings against them and will make a formal criminal complaint.

The bank wishes to apologize to Mr. Juma Kisaame for the inconvenience and any damages caused by this regrettable incidence” read the statement released on Monday by BoA admitting that indeed the information circulated on social media was an inside job.

Mr. Kisaame and DFCU have been in the spotlight following the bank’s takeover of Crane Bank in January 2017.

The Auditor General has in a new report since criticized the takeover and the manner in which other five commercial banks were sold by Bank of Uganda.

DFCU ‘bought’ Crane Bank from BoU in a process that Auditor General said wasn’t transparent given that DFCU was the valuer and purchaser of the same bank.

DFCU is said to have negotiated with authorities at BoU to buy Crane Bank Limited at Shs200 billion but as per AG report, only Shs90 billion has so far been paid to the central bank.

Reports indicate that ever since DFCU controversially acquired former Crane Bank from BoU, the Bank’s management has been struggling to manage business countrywide and that a big number of employees have since been shown the exit amid shareholder troubles.

CDC, DFCU’s oldest partner made an official communication to DFCU indicating that was jumping out of the now troubled over five decade old ‘marriage’ with DFCU.

The company’s Investment Director in charge of Financial Institutions, Irina Grigorenko, said it was “undertaking a review of its investment in DFCU Limited which may lead to the disposal of some or all of its shares in DFCU over the short to medium term.”

“It is our aspiration to exit in a manner that causes minimum disruption to the business and ensures the orderly trading of DFCU’s shares,” she wrote.

DFCU’s crisis was further deepened by the resignation and official exit of Deepak Malik, the Chief Executive Officer of Arise Holdings Ltd, which is its biggest shareholder from the board. Arise Holdings has 58% shares while CDC is DFCU’s oldest investor with more than five decades of working together.